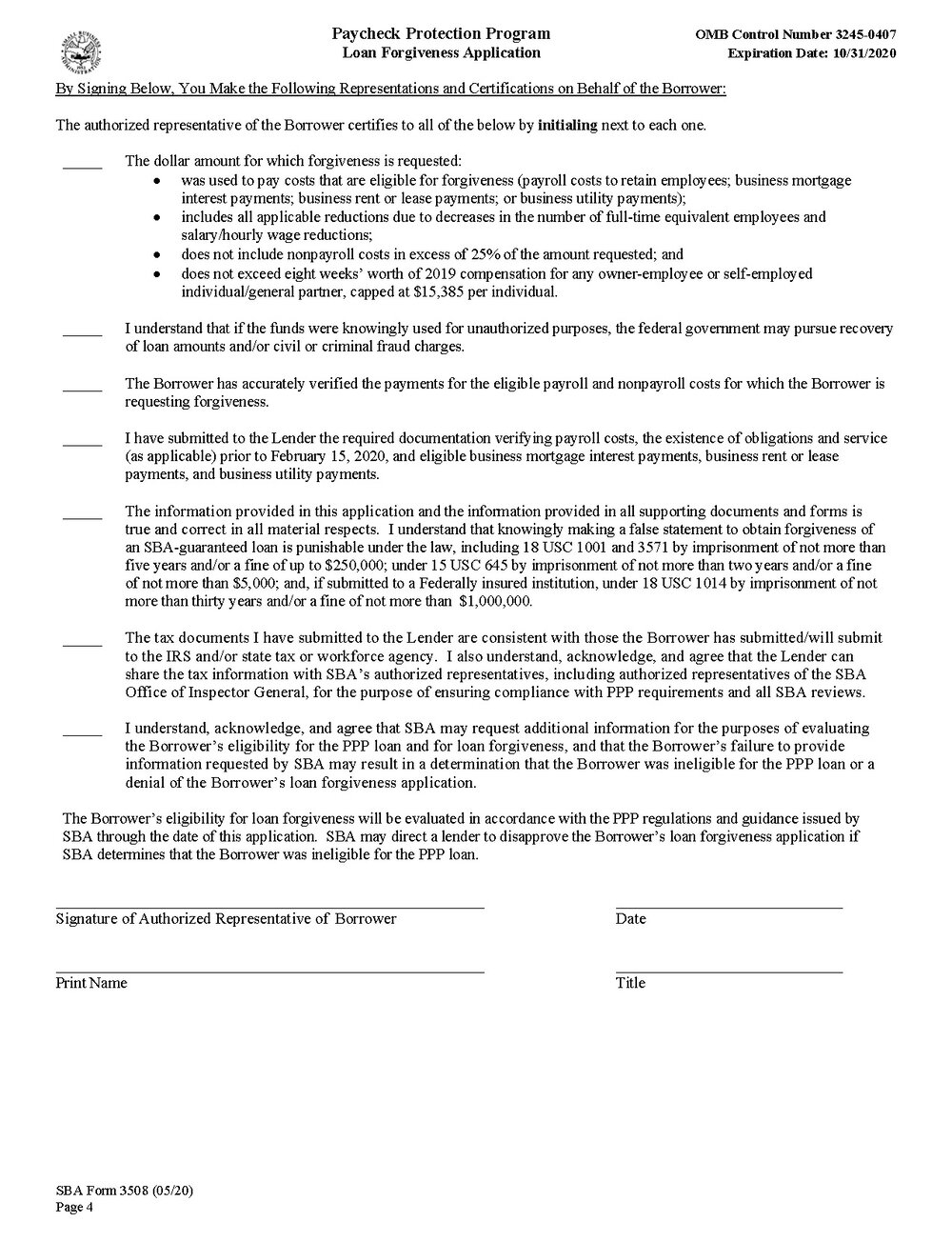

Supplier costs incurred before securing your PPP loan that was critical to business operations Property damage expenditures incurred as a result of public disturbances in 2020 that are not covered by insurance To have your PPP loan wholly forgiven, you must have spent PPP funds on the following expenses between 8 and 24 weeks from the day you received PPP funding:ĭuring the covered period you choose, at least 60% of loan proceeds must have been spent on payroll incurred, not necessarily paid (including the owner's pay, salaries, wages, vacation pay, leave pay, and health benefits, but not payments made to independent contractors) Ĭommercial rent (as long as the lease was in effect before February 15, 2020) The Paycheck Protection program ended on May 31, 2021. You can no longer get PPP loan approvals (Paycheck Protection Program loan). Credit card number Bank Identification Number (BIN) Lookup.Mortgage Choose a mortgage according to your needs.Credit cards Draw up the best bank card online.

#Blue acorn forgiveness application for free#

Requiring the disclosure of key individuals who own or control a legal entity (i.e., the beneficial owners) helps law enforcement investigate and prosecute these crimes. Legal entities can be abused to disguise involvement in terrorist financing, money laundering, tax evasion, corruption, fraud, and other financial crimes. To help the government fight financial crime, Federal regulation requires certain financial institutions to obtain, verify, and record in about the beneficial owners of legal entity customers at the time a new account is opened.

#Blue acorn forgiveness application code#

If your business falls under NAICS code 72 (Accommodation and Food Services), you may qualify for up to 3.5x monthly payroll costs for a second draw. PPP borrowers are eligible for up to 2.5x monthly payroll costs for their initial PPP loan, as well as any second draw. Approval and loan forgiveness are subject to your ability to meet government-set eligibility requirements. There are no fees for applying for PPP or forgiveness. BlueAcorn does not guarantee that applications will be processed and submitted before PPP funds are no longer available. BlueAcorn may need additional information from you later and does not guarantee that it will be able to submit your application to the SBA based solely on the information you provide now. If funds are available, qualified applications will be submitted to the SBA. Funds are limited, and may not be available at this time. Loan agreements will identify the appropriate lender to small businesses at signing. Small Business Administration ("SBA”) lenders. PPP loans are made by one or more approved U.S. Interest rates for the Paycheck Protection Program ("PPP') are at 1%. By accepting this agreement, you acknowledge and consent to all compensation the “business” receives from Blueacorn for this referral. Customer understands that the “business” may receive compensation for referring you to Blueacorn.

0 kommentar(er)

0 kommentar(er)